Apple Hits a $2 Trillion Market Cap

- Paul Thurrott

- Aug 19, 2020

-

45

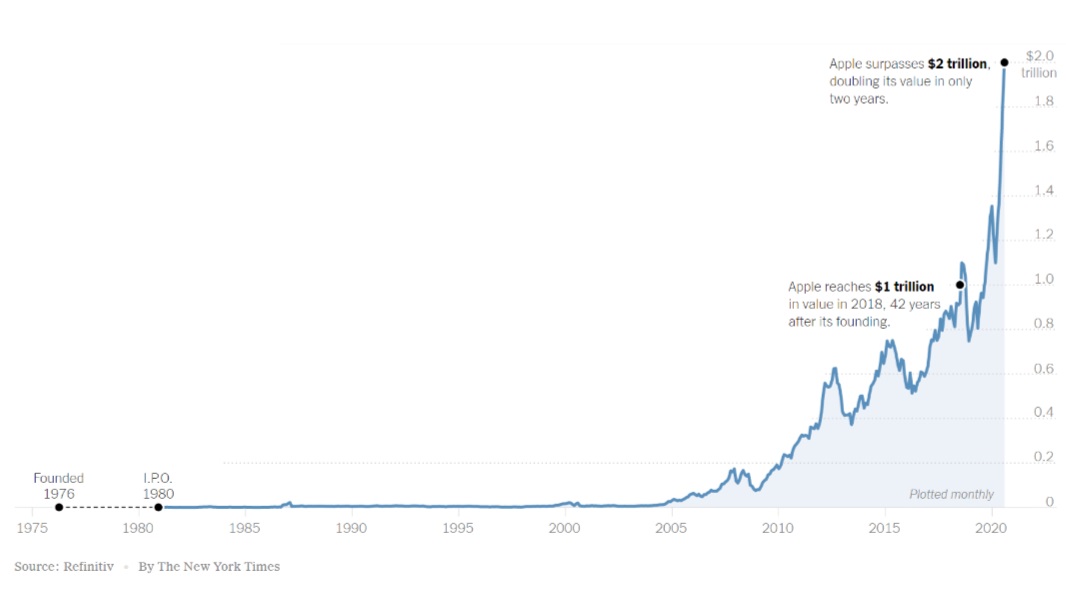

Just two years after it became the first U.S. company to reach a $1 trillion valuation by market capitalization, Apple is now worth $2 trillion and is the world’s most valuable company.

As The New York Times noted, it took Apple 42 years to reach $1 trillion in market cap. But it only took the firm 2 years to double that value and hit $2 trillion.

Windows Intelligence In Your Inbox

Sign up for our new free newsletter to get three time-saving tips each Friday — and get free copies of Paul Thurrott's Windows 11 and Windows 10 Field Guides (normally $9.99) as a special welcome gift!

"*" indicates required fields

Of course, this success has come during a time that has damaged much of the rest of the economy in ways that will have a lasting impact: Like other Big Tech firms, Apple has benefitted greatly from the misery caused by the COVID-19 pandemic. In fact, all of Apple’s most recent $1 trillion in gains have come during the pandemic, and the firm’s value has risen an average of $6.8 billion every single day during the pandemic.

And no, Apple isn’t alone: While the global economy has imploded during the pandemic, setting records of the wrong kind, the collective value of Amazon, Apple, Facebook, Google, and Microsoft has soared by $3 trillion during the pandemic. These five firms are now worth more than the next 50 biggest companies combined.

Apple is the second company in the world to reach a $2 trillion valuation: The Saudi Arabian Oil Company (Saudi Aramco) first hit that milestone in December 2019. But unlike Apple, Saudi Aramco has been hit by the pandemic because its business is based on fossil fuels and relatively few people are commuting, let alone traveling, this year. But Saudi Aramco is still worth about $1.8 trillion.

Conversation 45 comments

-

lvthunder

Premium MemberLog in to Reply<p>That goes to show you how much money the fed has stuck into the stock market system to prop it up. Apple's financials haven't doubled like that. Only the stock market price.</p>

-

jackwagon

Premium MemberLog in to Reply<p>"<span style="color: rgb(0, 0, 0);">But Saudi Aramco is still worth about $1.8 billion."</span></p><p><br></p><p>Should that be $1.8 trillion? I know the pandemic hit them, but ~99.9% loss of net worth is a bit extreme.</p>

-

Paul Thurrott

Premium MemberLog in to Reply<blockquote><em><a href="#562511">In reply to Jackwagon:</a></em></blockquote><p>Yep, thanks. Have a hard time wrapping my head around these numbers.</p>

-

kshsystems

Premium MemberLog in to Reply<p>I wonder how much that 100 million investment in Apple that Microsoft made some years ago, is worth today?</p>

-

ponsaelius

Log in to Reply<blockquote><em><a href="#562513">In reply to kshsystems:</a></em></blockquote><p>I believe it was $150 million and Microsoft cashed out in 2003.</p>

-

toukale

Log in to Reply<p>Who's going to be the first one to say it? "Doomed."</p>

-

RobertJasiek

Log in to Reply<p>Just looking at the chart, an implosion of the stock price is near.</p>

-

toukale

Log in to Reply<blockquote><em><a href="#562519">In reply to RobertJasiek:</a></em></blockquote><p>That's nothing new though, stock prices goes up and down all the time does not mean something is wrong with the company. Apple's executions has not changed before the stock went down as well as right now. I expect the stock price to go down between $50-$75 dollars right around the new iPhones announcement. It will present a buying opportunity for some.</p><p><br></p><p>Not sure why some think a company stock price going down as bad. I see it as a good thing because it presents an opportunity for young folks with little money to get in and hopefully benefits from the stock price going up. That's what Cook said was the main reason behind Apple's upcoming stock split.</p>

-

robsanders247

Premium MemberLog in to Reply<blockquote><em><a href="#562521">In reply to toukale:</a></em></blockquote><p>That $75 sounds likely as they plan to split their shares in 4. As the share price should reflect the long-term profit expectations, you would assume investors are already taking into account that at some point the true pain of the economic downturn will be felt by consumers (when additional unemployment benefits stop or companies are no longer receiving subsidies). But perhaps I’m too naive in my economic thinking.</p>

-

BrianEricFord

Log in to Reply<p>I assume that should be 1.8 trillion, rather than billion?</p>

-

Paul Thurrott

Premium MemberLog in to Reply<blockquote><em><a href="#562520">In reply to BrianEricFord:</a></em></blockquote><p>Yes, thanks!</p>

-

rusty chameleon

Log in to Reply<p>I bought a bunch of Apple stock in 2005. Sold 90% of it maybe ten years ago. Still have the rest, and it's up over 50x. Kicking myself for selling most of it long ago.</p>

-

Paul Thurrott

Premium MemberLog in to Reply<blockquote><em><a href="#562516">In reply to pecosbob04:</a></em></blockquote><p>Grudges should never be forgotten for sure.</p><p><br></p><p>To be fair, Mr. Dell was right when he said what he said. What happened to Apple after that was a miracle.</p>

-

miamimauler

Log in to Reply<blockquote><em><a href="#562539">In reply to paul-thurrott:</a></em></blockquote><p>Hi Paul, I see your posts are now showing who you are replying to. Please pass on my gratitude to tech support. ?</p>

-

Paul Thurrott

Premium MemberLog in to ReplyI wasn’t told about any changes, but I’ll ask now. 🙂

-

cavalier_eternal

Log in to Reply<blockquote><em><a href="#562516">In reply to pecosbob04:</a></em></blockquote><p>I don't think there was an issue with what Michael Dell said, he didn't see a way to save the company so he said what he would do. I would wager most CEOs at his level didn't see a way forward for Apple and what Jobs did is pretty remarkable. It has been funny to watch him spin that comment over the years though. </p>

-

Paul Thurrott

Premium MemberLog in to ReplyApple had no way forward. That it survived and then turned into a colossus isn’t just unprecedented, it will never happen again. It was a miracle.

-

SvenJ

Log in to Reply<p>Gee, guess getting a 30% take of imaginary stuff to be used in imaginary places is lucrative.</p>

-

joeaxberg

Premium MemberLog in to Reply<p>What's interesting is that even though Jobs died in 2011, almost 10 years ago, you still see the occasional article pop up about Cook living in the shadow of Steve Jobs and what's it like to take over the company after Jobs….Jobs this and Jobs that.</p><p><br></p><p>Jobs will certainly always be credited with Apple's emergence and re-emergence in computing. A truly unique founder.</p><p><br></p><p>But this is Tim Cook's company now. It has been for quite some time. This success is his imho. I think this was even mentioned on a recent Sunday TWIT.</p><p><br></p><p>The visionary is gone, replaced by the industrial engineer, and it is now a money making machine.</p><p><br></p><p>But of course…they're doomed… :-)</p>

-

wright_is

Premium MemberLog in to Reply<blockquote><em><a href="#562565">In reply to joeaxberg:</a></em></blockquote><p>Yes. Whether you like Apple or hate it, whether you like Tim or hate him, he took Steve's vision and ran with it, turning into one of the most successful Veblen goods producers the world has ever seen. </p><p>He is most definitely responsible for its growth, even under Jobs. If it hadn't been for him, Jobs visions might have failed at the supply chain stage, he is a master at his job. </p><p>The hardware side has stagnated somewhat, compared to the competition over the last few generations – the processors are great, but the design and features have always lagged behind the competition.</p><p>Android, for example, has been using NFC for things like setting up Wi-Fi access, booking into meeting rooms or making mobile payments directly out of the banking apps, without having to go through the Google Pay (the equivalent of Apple Pay) since around 2012/2013. I can also use it to authenticate myself with my NFC enabled national ID card. All things I can't (or couldn't) do with iOS.</p><p>But Apple still has that Veblen aura, at least in the US and that doesn't happen with somebody who doesn't know what they are doing at the helm.</p>

-

codymesh

Log in to Reply<p>this is what a rigged economy looks like.</p>

-

rosyna

Log in to Reply<blockquote><em><a href="#562569">In reply to codymesh:</a></em></blockquote><p><br></p><p> Stock price is a reflection of how confident rich people are in the potential of a company to change the confidence of other rich people in the future.</p><p><br></p><p>It, sadly, doesn’t reflect actual power or earning potential. For example, look at the S&P or NASDAQ hitting highs during a global pandemic. There may even be some shorters in there, <em>expecting</em> these stocks to fail soon.</p><p><br></p><p>I just friggin’ can’t stand this type of gambling and what it does to people.</p><p><br></p><p>It created the most hated man in America.</p>

-

arthemis

Log in to Reply<p>Yeah, a 2 trillion market cap and all the arrogance that comes with it.</p>

-

scovious

Log in to Reply<p><strong style="color: rgb(54, 119, 168);"><em>"I don’t think anybody reasonable is gonna come to the conclusion that Apple’s a monopoly. Our share is much more modest. We don’t have a dominant position in any market."</em></strong></p><p><br></p><p>Hmm…</p>

-

minke

Log in to Reply<p>Apple and all the other big tech companies still live in terror that someone, somewhere will invent the next great thing and all of a sudden their cash cows will disintegrate. Not saying I have a crystal ball, just that this fear drives a lot of the "evil" stuff you see these huge companies doing, like purchasing rival companies or crushing them if they don't sell. Look what happened with Microsoft and mobile phones. Arguably, they were a leader in that area, but didn't follow through and than the iPhone and Android came along. Or, look at IBM and the PC era. Apple is trying to diversify, but I really don't think slapping a subscription on everything is going to be a long-term win for them.</p>

-

arthemis

Log in to Reply<blockquote><em><a href="#562580">In reply to Minke:</a></em></blockquote><p>Youre only repeating big techs very flaved argument as to why they should be allowed to continue as they do. </p>

-

Truffles

Log in to Reply<blockquote><em><a href="#562585">In reply to naddy69:</a></em></blockquote><p>No, this is what a stockmarket looks like when the Fed spends a trillion dollars of tax payer money supporting corporate debt (much of which will end up as a naked wealth transfer to shareholders in the form of dividends and pumped stock prices).</p>

-

irfaanwahid

Log in to Reply<p>I find it funny that Microsoft which is sitting at 1.6T is still not considered in the league of big boys by most of the media houses. The FOUR has they like to call it, are referred to Facebook, Amazon, Apple and Google (FANG).</p>

-

codymesh

Log in to Reply<blockquote><em><a href="#562585">In reply to naddy69:</a></em></blockquote><p>how can you say this? even if a garage startup somehow starts post-pandemic (less likely than in the past because middle-class people have had their savings wiped), it will never get to become as big because the big 4 will absolutely acquire it, further contributing to this absurdity. </p><p><br></p><p>Maybe when Apple hits $3 trillion you'll come around to maybe thinking that today's "free market" really isn't.</p>

-

wright_is

Premium MemberLog in to Reply<p>(pokes head over the parapit) That is 2 billion dollars in real money! Darned cheapskate Americans! 😛 :-D</p><p>I never understood why Americans adopted the cheapskate billion and trillion. It makes it difficult when communicating with the rest of the world, where billion and trillion still have their original meanings (billion is a 1,000,000,000,000 and a trillion is 1,000,000,000,000,000,000).</p><p>I have to stop and think every time I switch between German and US English, that I have to readjust things. Bill Gates and Jeff Bezos are milliardares in German and Apple has just broken the $2 billion mark, according to German TV…</p>

-

red.radar

Premium MemberLog in to Reply<blockquote><em><a href="#562613">In reply to wright_is:</a></em></blockquote><p>I thought billion and trillion were defined by the SI system ? Which you can thank the French for … </p>

-

Chris_Kez

Premium MemberLog in to Reply<blockquote><em><a href="#562613">In reply to wright_is:</a></em></blockquote><p>I had no knowledge of short-scale and long-scale until today; I'm amazed! I can see some logic in sticking with a single suffix, but more importantly the -<em>illiard </em>sounds terrible to my ear ;P</p>

-

wright_is

Premium MemberLog in to Reply<blockquote><em><a href="#562850">In reply to Chris_Kez:</a></em></blockquote><p>Probably because you aren't used to it. You get it all the time in the news here, when talking about milliardaires, like Gates, Bezos and Co. Or companies being worth so many milliard Euros or Dollars. It doesn't sound terrible to me any more.</p>

-

dcdevito

Log in to Reply<p>It’s mind boggling how successful Apple is, especially considering even in the US their market share is as low as it is. </p>

-

Paul Thurrott

Premium MemberLog in to ReplyApple sold over 50 percent of all smartphones in the U.S. in the most recent quarter.

-

red.radar

Premium MemberLog in to Reply<p>considering the way governments are printing money should the 2T evaluation be adjusted for inflation? </p><p><br></p><p>also a indication of how the stock market is protecting wealth. They are stuffing it in a few very successful companies that really don’t do anything with all this money. It would be interesting to break up Apple … Google … Facebook… amazon… ect… to see if the investment spreads out and what positive effect it could have. It looks like way too much capital is locked up and not being put to use </p><p><br></p>

-

Mike Brady

Log in to Reply<p><span style="color: rgb(0, 0, 0);">Obviously, Apple products aren't made for me, which is probably why Apple is worth so much. </span></p><p><br></p><p>I'm not an Apple hater, but stories like this amaze me because I've never felt the desire to buy an Apple product. On those rare occasions that I visit a mall, I usually stop by the Apple store and tinker with their displays. I think, "pretty. nice monitor, but this costs how much?!?!?" Then I begin to figure out how much effort it would take to spend that much money on a PC.</p><p><br></p><p>A long time ago when everyone was going nuts over the iPod, a friend gave me his previous model when he upgraded. After buying various adapters to get it to connect to things, I could never get in to it that much and returned to my simple $30 MP3 players that were the alternative at the time.</p><p><br></p><p>Today when I help family members with their iPhones, I think the same thing as I do with the Macs. "These cost how much?"</p><p><br></p><p><br></p><p><br></p>

-

karlinhigh

Premium MemberLog in to Reply<blockquote><em><a href="#562667">In reply to wright_is:</a></em></blockquote><p>Wikipedia quotes British dictionary man Henry Watson Fowler in 1924:</p><p><br></p><p><em>It should be remembered that "billion" does not mean in American use (which follows the French) what it means in British. For to us it means the second power of a million, i.e. a million millions (1,000,000,000,000); for Americans it means a thousand multiplied by itself twice, or a thousand millions (1,000,000,000), what we call a milliard. Since billion in our sense is useless except to astronomers, <u>it is a pity that we do not conform.</u></em></p><p><br></p><p>Emphasis mine. From what I'm hearing, the desired conformity of this "lexicographical genius" has come to pass.</p><p><br></p><p>Then Wikipedia says…</p><p><br></p><p><em>Although American English usage did not change, within the next 50 years French usage changed from short scale to long and British English usage changed from long scale to short.</em></p><p><br></p><p>America's government isn't (yet) central-bureaucracy enough to pull off societal changes following every whim of fashion like that.</p>

-

geoff

Log in to Reply<p>It's like I had my spokesperson say at Davos just the other day . . .</p><p><br></p><p>The *first* trillion may sometimes seem like hard work.</p><p>But after that, they just get easier and easier.</p><p><br></p><p><br></p>

-

Paul Thurrott

Premium MemberLog in to Replylol

-

warrickdean

Log in to Reply<blockquote><em><a href="#562621">In reply to wright_is:</a></em></blockquote><p>Many moved to the short scale a long time ago. I'm an Australian in my 40s, and I've always been taught short scale (with my elders reminding me that "it didn't used to be that way."</p><p>Looking at the wikipedia article on billion, the UK government moved to the short scale officially in 1974 (noting the long scale still "<span style="color: rgb(32, 33, 34);">enjoys some limited usage in the UK").</span></p>

-

wright_is

Premium MemberLog in to Reply<blockquote><em><a href="#562786">In reply to warrickdean:</a></em></blockquote><p>I was in school through the 70s until mid 80s and we were taught long-scale and the BBC news used long-scale as well, when I was growing up.</p>

-

codymesh

Log in to Reply<blockquote><em><a href="#562670">In reply to pecosbob04:</a></em></blockquote><p>it is no longer the late 80's and 90's. </p>