Alphabet Posts a Big Quarter Too

- Paul Thurrott

- Feb 02, 2021

-

12

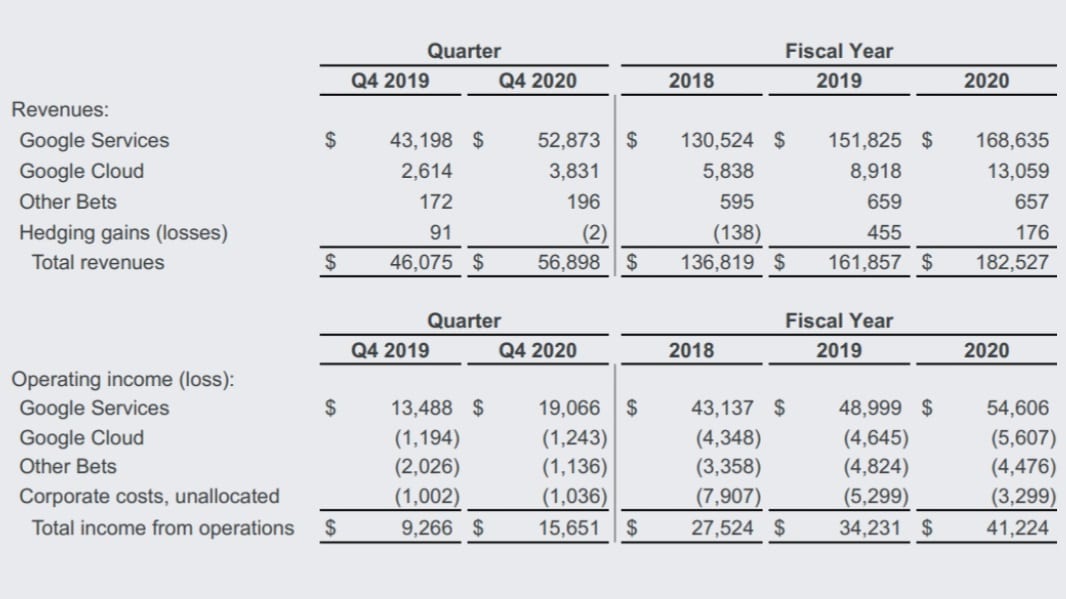

Google owner Alphabet today reported that it earned a net income of $15.65 billion on revenues of $56.9 billion for the quarter ending December 31, 2020. For the full year 2020, Alphabet reported $41.2 billion on revenues of $182.5 billion.

“Our strong results this quarter reflect the helpfulness of our products and services to people and businesses, as well as the accelerating transition to online services and the cloud,” Google and Alphabet CEO Sundar Pichai said. “Google succeeds when we help our customers and partners succeed, and we see significant opportunities to forge meaningful partnerships as businesses increasingly look to a digital future.”

Windows Intelligence In Your Inbox

Sign up for our new free newsletter to get three time-saving tips each Friday — and get free copies of Paul Thurrott's Windows 11 and Windows 10 Field Guides (normally $9.99) as a special welcome gift!

"*" indicates required fields

As usual, Google delivered most of Alphabet’s revenues and all of its net income, with Alphabet’s other bets all delivering losses. Google Services contributed $52.9 billion in net income in the quarter, Google Cloud added $3.8 billion, and Alphabet’s other bets added $196 million.

Google’s advertising business contributed $46.2 billion in revenues in the quarter, spread out across Google Search ($32 billion), YouTube ads ($6.9 billion), and other advertising. Overall, advertising accounted for 81.2 percent of Alphabet’s revenues. Google’s non-advertising revenues were $6.7 billion.