Apple is First Company to Hit $3 Trillion Valuation

- Paul Thurrott

- Jan 03, 2022

-

32

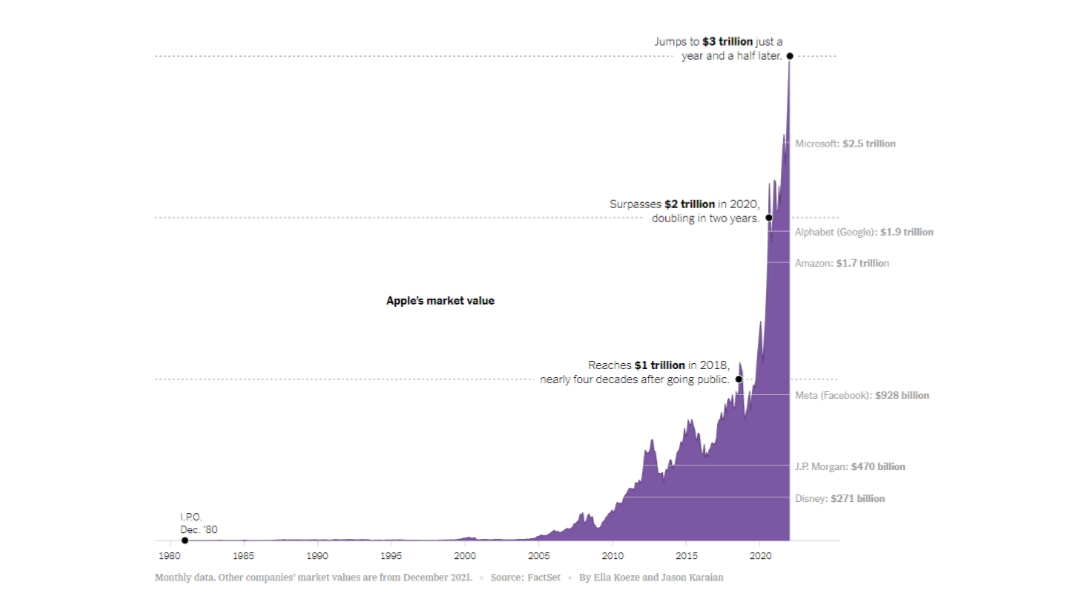

Today, Apple became the first publicly-traded company to reach a $3 trillion valuation by market capitalization. Not bad for a firm that was headed for insolvency in the late 1990s.

What’s most impressive about this milestone, perhaps, is how Apple’s value has soared in recent years. It took the firm 42 years to reach the $1 trillion market cap milestone, a feat it first accomplished in 2018. It then took Apple only two years to double that valuation to $2 trillion, in 2020. And now it has reached $3 trillion in just 18 months.

Windows Intelligence In Your Inbox

Sign up for our new free newsletter to get three time-saving tips each Friday — and get free copies of Paul Thurrott's Windows 11 and Windows 10 Field Guides (normally $9.99) as a special welcome gift!

"*" indicates required fields

The New York Times has some nice comparisons to put that number in perspective. $3 trillion is worth more than Walmart, Disney, Netflix, Nike, Exxon Mobil, Coca-Cola, Comcast, Morgan Stanley, McDonald’s, AT&T, Goldman Sachs, Boeing, IBM, and Ford … combined. It’s worth more than the value of all of the world’s cryptocurrencies. It is about the same as the gross domestic product of Britain or India. Or the same as about six JPMorgan Chases or 30 General Electrics.

Put another way, Apple is now worth nearly 7 percent of the total value of the S&P 500, a record. The previous record-holder was IBM, which was worth 6 percent of the S&P 500 in 1984.

But here’s some good news for Microsoft fans: the software giant is currently worth over $2.5 trillion and it is expected to follow Apple north of the $3 trillion line later this year.