Microsoft Earnings Beat All Expectations as AI Bet Pays Off

- Paul Thurrott

- Apr 25, 2024

-

3

Microsoft announced that it earned a net income of $21.9 billion on revenues of $61.9 billion in the quarter ending March 31. Those figures represent dramatic growth over the same quarter one year ago, with net income up 20 percent and revenues up 17 percent.

“It was a record third quarter, powered by the continued strength of the Microsoft Cloud, which surpassed $35 billion in revenue, up 23 percent,” Microsoft CEO Satya Nadella said in a post-earnings conference call. “Microsoft Copilot and Copilot stack—spanning everyday productivity, business process, and developer services, to models, data, and infrastructure—are orchestrating a new era of AI transformation, driving better business outcomes across every role and industry.”

Windows Intelligence In Your Inbox

Sign up for our new free newsletter to get three time-saving tips each Friday — and get free copies of Paul Thurrott's Windows 11 and Windows 10 Field Guides (normally $9.99) as a special welcome gift!

"*" indicates required fields

Suffice to say that Microsoft’s business is firing on all cylinders. Unless, of course, you care about hardware.

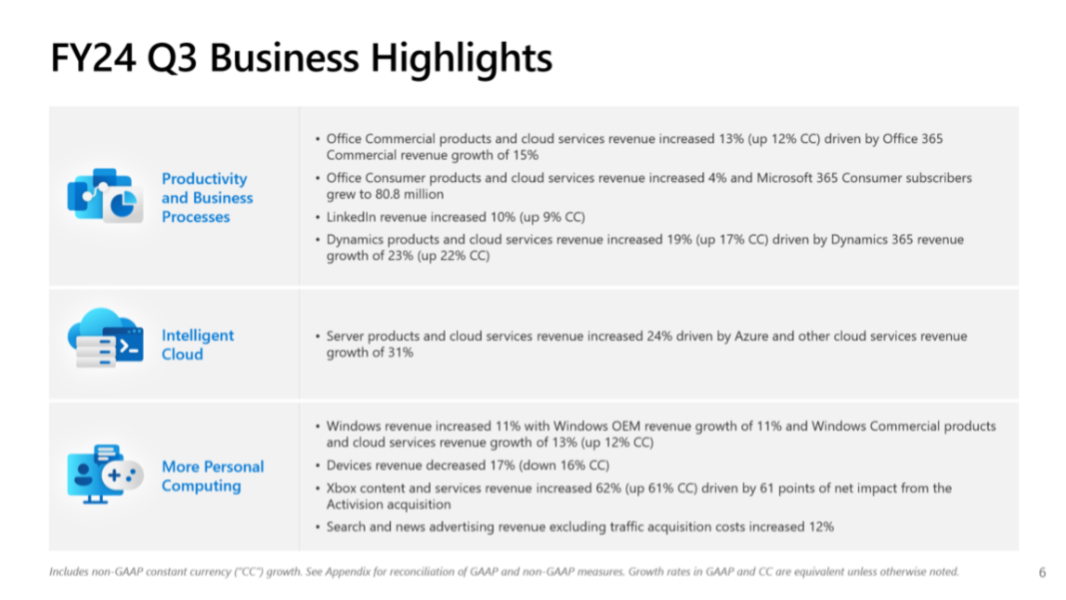

Intelligent Cloud was again Microsoft’s biggest business unit, with $26.7 billion in revenues, up 21 percent year-over-year (YOY) and driven primarily by Azure. Server and cloud services revenue was up 24 percent, while Azure and other cloud services revenue jump 30 percent; AI services contributed 7 points of growth to Azure. Microsoft also reported that its Enterprise Mobility installed base grew 10 percent to over 274 million seats.

Productivity and Business Processes delivered $19.6 billion in revenues, a gain of 12 percent YOY and driven by Office 365. Office commercial products and cloud services revenues were up 13 percent, while Office 365 commercial revenue was up 15 percent. Office 365 commercial seats grew by 15 percent. On the consumer side, Office consumer products and services revenue grew 4 percent and the Microsoft 365 consumer subscriber base hit 80.8 million, up 14 percent YOY.

And as always, More Personal Computing brought up the rear, with $15.6 billion in revenues, up 12 percent YOY. Windows revenues from PC makers jumped 11 percent (compared to a 28 percent drop-off a year earlier), and Windows commercial products and services revenues grew 13 percent YOY. But Microsoft’s hardware businesses fared poorly, with Surface revenues down 17 percent YOY (following drops of 9, 22, 20, and 30 percent in the previous four sequential quarters). And Xbox hardware revenues were down 31 percent.

In slightly better news, Xbox content and services revenue leaped 62 percent YOY, even better than the holiday quarter, and gaming revenue was up 51 percent overall.

A few other data points.

- Mr. Nadella credited Microsoft’s big showing this quarter largely to AI, which drove growth in Azure, via both new customers and the average spend per customer.

- Over 60 percent of the Fortune 500 now uses Copilot.

- Copilot in Windows is now available on nearly 225 million PCs (Windows 10 and 11), up 200 percent quarter over quarter.

- GitHub Copilot now has over 1.8 million paid subscribers, with 35 percent growth YOY. Over 90 percent of the Fortune 500 is using this AI-powered developer service, with revenues in that market up 45 percent YOY.

- Bing has over 140 million daily active users.

- In gaming, Microsoft set third (fiscal) quarter records for game streaming hours, console usage, and monthly active devices. Game Pass subscribers played over 10 million hours of Diablo IV, the first–and, notably, only–Activision Blizzard title to reach the service within the first 10 days of availability.

- Activision contributed a net impact of approximately 4 points to revenue growth, Microsoft CFO Amy Hood noted, and gaming results were ahead of expectations, primarily driven by the continued success of Call of Duty. But Activision was also a 2 point drag on operating income growth, and had a negative 4 cent impact to earnings per share. (These shortfalls are temporary and are related to transition costs.)

- Overall Surface demand was only slightly lower than expected. Hood said the company “remain focused on [its] higher margin premium products,” but one has to wonder what happens if the new generation of Surface PCs fails too.

Looking ahead, Microsoft expects revenue growth of 19-20 percent for Intelligent Cloud, 9 to 11 percent in Productivity and Business Processes, and 10 to 13 percent in More Personal Computing, with low single-digit growth in Windows revenues from PC makers and “mid-teens” declines in Surface. Gaming should experience growth in the low to mid-40s.

But here’s the most amazing bit.

“We now expect full-year full year 2024 [which ends June 30] operating margins to be up over 2 points year-over-year even with our cloud and AI investments, the impact from the Activision acquisition, and the headwind from the change in useful lives last year,” Ms. Hood said. “This operating margin expansion reflects the hard work across every team to drive efficiencies and maintain disciplined cost management knowing we will continue to grow our cloud and AI investments next year.”